52+ how much of your income should be spent on mortgage

Easily Compare Mortgage Rates and Find a Great Lender. Web 28 of Gross Income.

What Percentage Of Your Income Should Go To Mortgage Chase

Start By Checking The Requirements.

. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Last week the average rate was. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

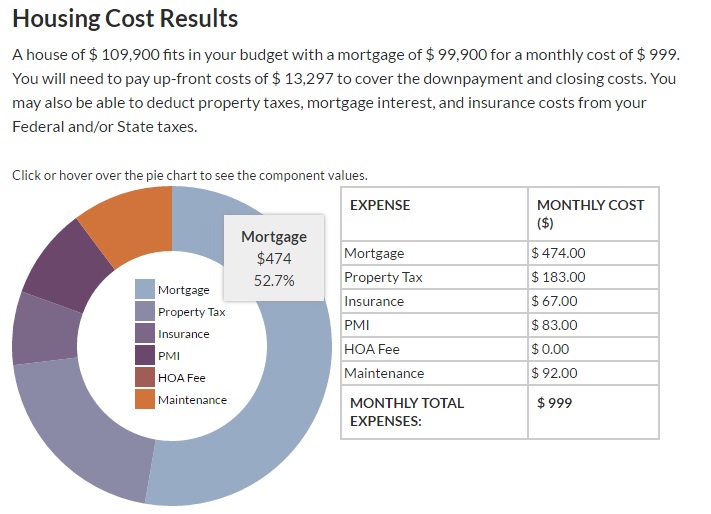

Web The 2836 rule stipulates that in order for a home to be considered within your budget your housing expenses such as mortgage payments taxes and insurance. The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross rather than net income.

Ad Home Financing Mortgage Loans for Vermonters. Ideally that means your monthly. Are You Eligible For The VA Loan.

The 28 rule isnt universal. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Web To consider how much you can afford in a mortgage payment multiply your comfortable DTI by your gross monthly income.

Web The market and share of income spent on a mortgage may fluctuate based on the current mortgage rate the typical local homeowners income and the typical local home value. Calculate Your Monthly Loan Payment. This rule says you.

This rule says that you should not. Web According to this rule your mortgage payment shouldnt be more than 28 of your monthly pre-tax income and 36 of your total debt. Web Lenders use your debt-to-income ratio DTI as a measure of affordability.

Web A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your bank account. Easily Compare Mortgage Rates and Find a Great Lender. First Time Home Buyer.

And you should make. Ad Get Preapproved Compare Loans Calculate Payments - All Online. For example if your gross monthly.

Web This refers to the recommendation that you should not spend any more than 28 of your gross income on the total amount you pay for your mortgage monthly. And they see a 28 DTI as an excellent one. Ad See If Youre Eligible for a 0 Down Payment.

Web Rule Of 28. Lock In Your Low Rate Today. Web The 3545 Model.

First Time Home Buyer. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Learn More Become A Member Today.

Yet the average married couple with children. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income. Web It recommends you spend up to 50 of your monthly after-tax income aka net income toward essential expenses needs like your mortgage payment utility.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web To use this calculation to figure out how much you can afford to spend multiply your gross monthly income by 028. Make Change Simply by Banking.

Answer Simple Questions See Personalized Results with our VA Loan Calculator. Currently the average interest rate on a 51 ARM is 570 up from the 52-week low of 323. Web 23 hours ago51 Adjustable-Rate Mortgage Rates.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. This is also known as the. Some financial experts recommend other percentage models like the 3545 model.

8000 35 2800. A Credit Union for All Vermonters. Web Financial planners recommend limiting the amount you spend on housing to 25 percent of your monthly budget.

One calculation to calculate how much of your income can go towards your mortgage payment is the 28 rule. Ad Calculate and See How Much You Can Afford.

Affordability Calculator How Much House Can I Afford Zillow

Personal Budget Examples 17 Samples In Google Docs Google Sheets Excel Word Numbers Pages Pdf Examples

How Much Of My Income Should Go Towards A Mortgage Payment

![]()

How Much House Can I Afford Interest Com

How Much Home Can You Afford Advanced Topics

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Income Should Go To A Mortgage Bankrate

Conservative Mortgage Calculator How Much Home Can You Really Afford Personal Finance Data

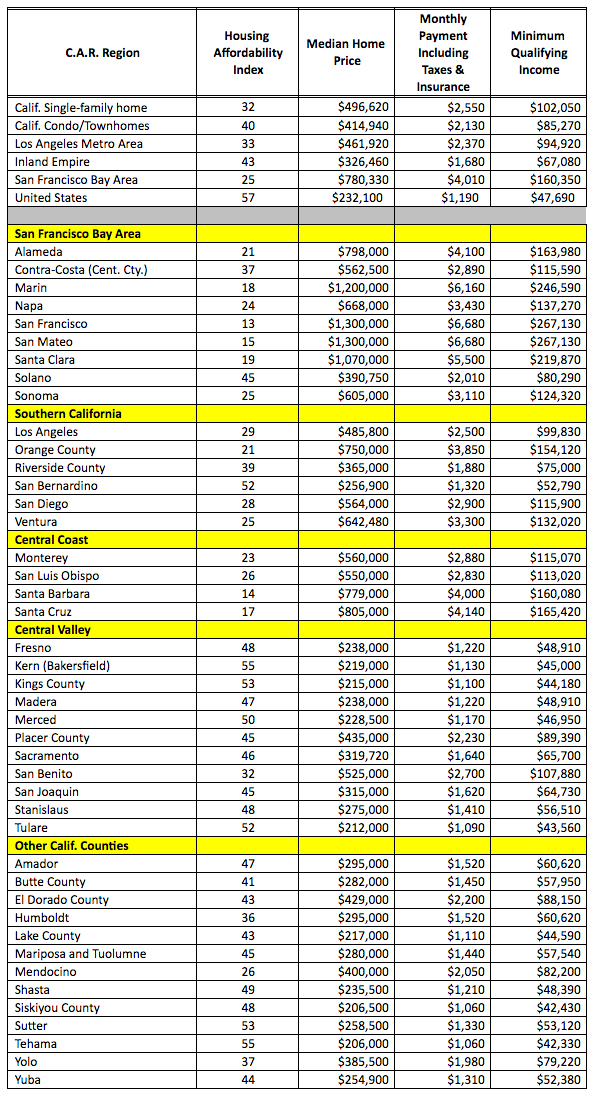

Need A Mortgage In California Realtors Say You Better Earn This Much Money Housingwire

What Percentage Of Income Should Go To Mortgage Banks Com

Dom Wong Domwong Twitter

What Percentage Of Your Income Should Go To Mortgage Chase

Work From Home Jobs Australia 52 Jobs You Can Do From Home Work With Joshua

52 Houses For Rent In Jodhpur Between 15000 To 25000

Pay Off Your Mortgage Live Debt Free How One Guy Did It In 3 Years R Financialindependence

What Percentage Of Your Income Should Your Mortgage Be

3 Bhk Flats Near Mata Mandir Sec 52 Vill Hoshiyarpur Hoshiyarpur Sector 51 Noida 52 3 Bhk Flats For Sale Near Mata Mandir Sec 52 Vill Hoshiyarpur Hoshiyarpur Sector 51 Noida